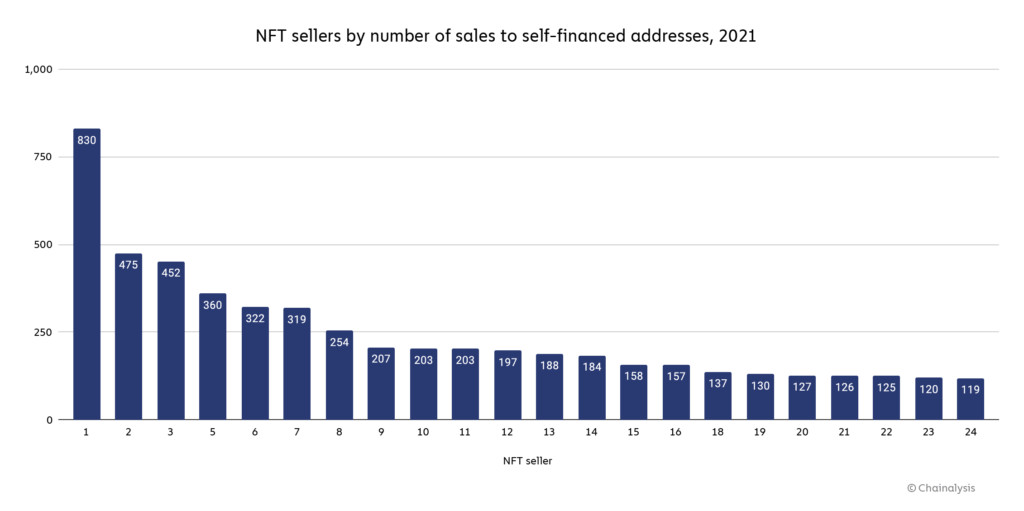

NFT wash trading is when a trader sells their digital art to another wallet that they control, giving the illusion that the collectible appears more valuable by artificially increasing its trading volume. The report identified 262 users who self-traded more than 25 times, though it clarified that it can’t be absolutely certain that all these accounts practiced wash trading. The firm added that the most prolific wash trader made 830 sales to self-financed crypto wallets. However, calculations show that the trader had also made a loss due to gas fees, which are charged for each transaction. Overall, less than half of the traders in the analysis made a profit after accounting for the fees, with profitable users making almost US$8.9 million (~RM37.2 million). The NFT marketplace grew exponentially last year, from US$106 million (~RM443 million) in 2020 to a staggering US$44.2 billion (~RM185 billion) in 2021. Because the digital tokens are not considered a security, they are not subject to laws that would otherwise prevent practices such as wash trading, plagiarism, and money laundering. (Source: Chainalysis)